Internet is full of older people lamenting that younger generations don’t know how to balance a checkbook. Arguably, with wide-spread access to online banking, this doesn’t seem quite as useful anymore – you can just log into your account and check balances. However, if you write checks, this may be insufficient, as you may not be realizing that some money is yet to come out.

If you have a new business, you should be keeping track of all your transactions and sooner or later, they will need to be recorded outside your bank statement. Once you make a list of transactions, you will need to balance your checkbook (or, as accountants call it: reconcile the account) regularly.

Here are steps to getting it done:

Record Transactions:

- Keep a record of all your financial transactions. This includes deposits, withdrawals, checks written, and any electronic transactions.

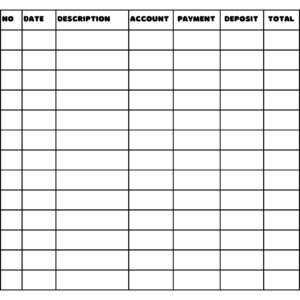

Use a Check Register:

- Obtain a check register from your bank or create a simple one on paper or electronically. A check register is a ledger where you can record your transactions.

- You can get some ledger notebooks from Amazon – here are some options I created:

- Or you can use an excel file, such as this one.

Start with the Beginning Balance:

- Record the beginning balance in your check register. This is the amount of money you have in your account at the start of the period.

Record Deposits:

- When you deposit money into your account, record it in the check register. Include the date, the source of the deposit, and the amount.

Record Withdrawals:

- When you make withdrawals or write checks, record these transactions in the check register. Include the date, payee, and the amount.

Record Electronic Transactions:

- If you use a debit card or make online transactions, record these in your check register as well. Include the date, a brief description, and the amount.

Update the Balance:

- After each transaction, update your check register by adjusting the balance. For deposits, add the amount; for withdrawals, subtract the amount.

Reconcile Regularly:

- Compare your check register with your bank statement regularly, typically monthly. Make sure all transactions match, and there are no discrepancies.

Identify Discrepancies:

- If you find any discrepancies between your check register and the bank statement, investigate them. It could be a missing transaction or an error in recording.

Adjust the Check Register:

- Make any necessary adjustments in your check register based on the information from the bank statement. This ensures that your records match the bank’s records.

End with the Ending Balance:

- Once you’ve reconciled all transactions, the ending balance in your check register should match the ending balance on your bank statement.

Keep Records:

- File your bank statements and keep a copy of your reconciled check register. This documentation is essential for tracking your financial history.